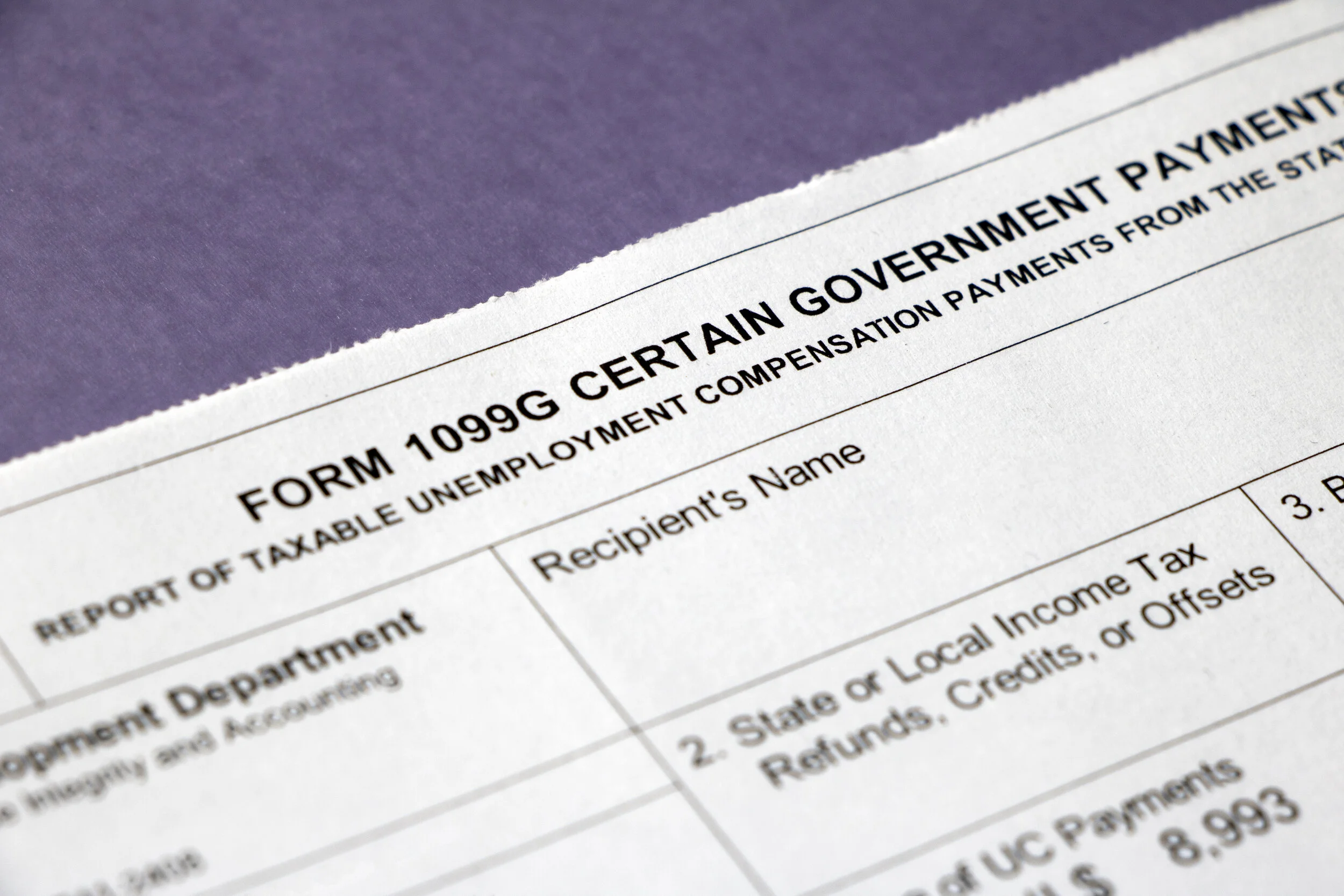

Yes. Unemployment compensation, particularly jobless benefits, is considered taxable income for federal income tax purposes and for some states too.

Read MoreGambling losses can be deducted up to the amount of winnings, not more. They can be claimed as a miscellaneous deduction on Schedule A, Form 1040, if you itemize deductions. It is important to keep an accurate diary or similar record of your gambling winnings and losses for tax preparation purposes and in case of an audit.

Read MoreUp to 85% of social security retirement benefits may be includable in gross income on your tax return, which means it may be taxable. The amount of taxable income depends on the filing status on the tax return, total amount of benefits received, and other income earned. This is important to those who continue to work while receiving social security retirement benefits.

Read MoreThose who are not required to file a tax return, “non-filers”, because their income is below the filing requirement must register with the IRS to receive their EIP or stimulus check. Registration is quick, easy, and secure through the IRS website at Non-Filers. The registration deadline has been extended to November 21 Midnight ET.

Read MoreThe Internal Revenue Service (IRS) provides free and secure online tax return preparation and filing services to taxpayers. You can file online with IRS Free File until October 15 at midnight ET.

Read More