Tax Planning and Tax Brackets

What is a Tax Bracket?

The U.S. income tax is a progressive tax by which tax rates increase as taxable income increases. Those who earn more income pay more tax, all other things being equal®. The Internal Revenue Service (IRS) has established tax brackets by filing status.

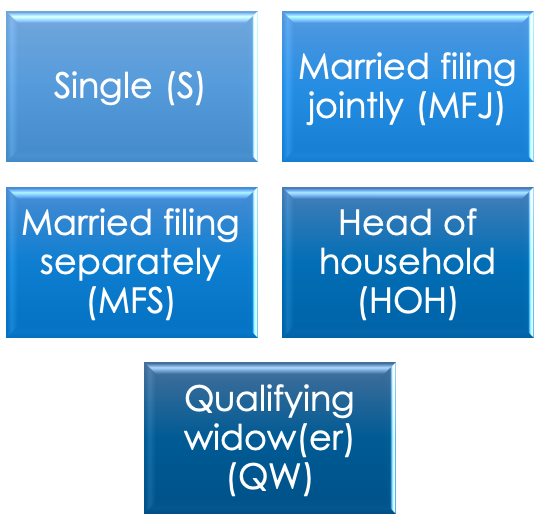

There are five filing statuses. Taxpayers must meet specific requirements to qualify for each filing status.

A tax bracket is a range of taxable income taxed at specific rates. The marginal tax rate is the rate at which the last dollar of income is taxed or the percentage of tax applied to your taxable income for each tax bracket in which you qualify.

The seven tax brackets are: 10%, 12%, 22%, 24%, 32%, 35% and 37%.

On January 1, every taxpayer, regardless of filing status, starts the year with zero income and is in the lowest tax bracket for their filing status, which for all filing statuses is 10%. As income is earned throughout the year, taxpayers pass to the next bracket. Thus, the income earned above the 10% bracket (more than $9,875, for single filers, and below $40,125) is taxed at 12%. This continues as the taxpayer's income rises until the end of the year. For example, a single taxpayer with taxable income of $60,000 does not pay 22% tax on the full amount. The first $9,875 in earnings will be taxed at 10%. From $9,876 to $40,125 will be taxed at 12%, and the rest will be taxed at 22%.

Tax planning primarily concerns the timing and the method by which your income is reported and your deductions and credits are claimed. The basic strategy for year-end planning is to time your income so that it will be taxed at a lower rate and to time your deductible expenses so that they may be claimed in years when you are in a higher tax bracket.

Understanding how tax brackets work, as well as which bracket you are in, can help you make better informed financial decisions and determine the amount of tax due or refund with reasonable accuracy.

Take Action

Recognize income when your tax bracket is low - consider postponing the year-end bonus to the first payroll in year 2021 if earning it in 2020 effects your tax situation negatively.

Pay deductible expenses when your tax bracket is high

Postpone incurrence of income tax liability whenever possible

Tax planning doesn’t begin and end on April 15th. Planning for the tax consequences of financial and life events as they occur can save you money and/or eliminate a surprise balance due when you file your taxes.

We’re here to help. Contact us.